Advertisement

-

Published Date

July 29, 2023This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

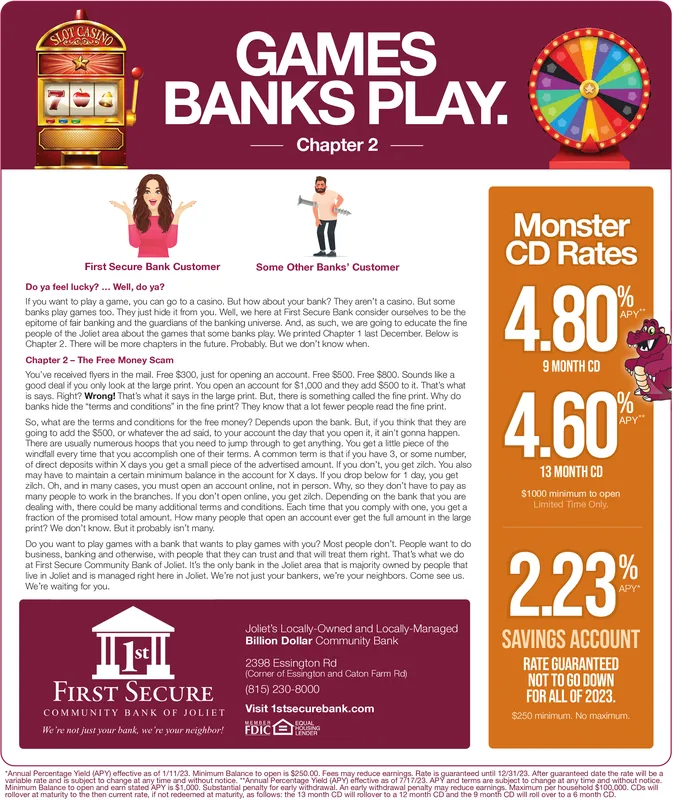

SLOT CASINO GAMES 709! BANKS PLAY. First Secure Bank Customer Chapter 2 Some Other Banks' Customer Do ya feel lucky? ... Well, do ya? If you want to play a game, you can go to a casino. But how about your bank? They aren't a casino. But some banks play games too. They just hide it from you. Well, we here at First Secure Bank consider ourselves to be the epitome of fair banking and the guardians of the banking universe. And, as such, we are going to educate the fine people of the Joliet area about the games that some banks play. We printed Chapter 1 last December. Below is Chapter 2. There will be more chapters in the future. Probably. But we don't know when. Chapter 2 - The Free Money Scam You've received flyers in the mail. Free $300, just for opening an account. Free $500. Free $800. Sounds like a good deal if you only look at the large print. You open an account for $1,000 and they add $500 to it. That's what is says. Right? Wrong! That's what it says in the large print. But, there is something called the fine print. Why do banks hide the "terms and conditions in the fine print? They know that a lot fewer people read the fine print. So, what are the terms and conditions for the free money? Depends upon the bank. But, if you think that they are going to add the $500, or whatever the ad said, to your account the day that you open it, it ain't gonna happen. There are usually numerous hoops that you need to jump through to get anything. You get a little piece of the windfall every time that you accomplish one of their terms. A common term is that if you have 3, or some number, of direct deposits within X days you get a small piece of the advertised amount. If you don't, you get zilch. You also may have to maintain a certain minimum balance in the account for X days. If you drop below for 1 day, you get zilch. Oh, and in many cases, you must open an account online, not in person. Why, so they don't have to pay as many people to work in the branches. If you don't open online, you get zilch. Depending on the bank that you are dealing with, there could be many additional terms and conditions. Each time that you comply with one, you get a et a fraction of the promised total amount. How many people that open an account ever get the full amount in the large print? We don't know. But it probably isn't many. FIRST SECURE COMMUNITY BANK OF JOLIET We're not just your bank, we're your neighbor! Do you want to play games with a bank that wants to play games with you? Most people don't. People want to do business, banking and otherwise, with people that they can trust and that will treat them right. That's what we do at First Secure Community Bank of Joliet. It's the only bank in the Joliet area that is majority owned by people that live in Joliet and is managed right here in Joliet. We're not just your bankers, we're your neighbors. Come see us. We're waiting for you. Joliet's Locally-Owned and Locally-Managed Billion Dollar Community Bank 2398 Essington Rd (Corner of Essington and Caton Farm Rd) (815) 230-8000 Visit 1stsecurebank.com MEMBER FDIC EQUAL HOISING LENDER Monster CD Rates 4.80% 9 MONTH CD 4.60 13 MONTH CD $1000 minimum to open Limited Time Only. APY** 2.23% SAVINGS ACCOUNT RATE GUARANTEED NOT TO GO DOWN FOR ALL OF 2023. $250 minimum. No maximum. *Annual Percentage Yield (APY) effective as of 1/11/23. Minimum Balance to open is $250.00. Fees may reduce earnings. Rate is guaranteed until 12/31/23. After guaranteed date the rate will be a variable rate and is subject to change at any time and without notice. "Annual Percentage Yield (APY) effective as of 7717/23. APY and terms are subject to change at any time and without notice. Minimum Balance to open and earn stated APY is $1,000. Substantial penalty for early withdrawal. An early withdrawal penalty may reduce earnings. Maximum per household $100,000. CDs will rollover at maturity to the then current rate, if not redeemed at maturity, as follows: the 13 month CD will rollover to a 12 month CD and the 9 month CD will roll over to a 6 month CD. SLOT CASINO GAMES 709 ! BANKS PLAY . First Secure Bank Customer Chapter 2 Some Other Banks ' Customer Do ya feel lucky ? ... Well , do ya ? If you want to play a game , you can go to a casino . But how about your bank ? They aren't a casino . But some banks play games too . They just hide it from you . Well , we here at First Secure Bank consider ourselves to be the epitome of fair banking and the guardians of the banking universe . And , as such , we are going to educate the fine people of the Joliet area about the games that some banks play . We printed Chapter 1 last December . Below is Chapter 2. There will be more chapters in the future . Probably . But we don't know when . Chapter 2 - The Free Money Scam You've received flyers in the mail . Free $ 300 , just for opening an account . Free $ 500 . Free $ 800 . Sounds like a good deal if you only look at the large print . You open an account for $ 1,000 and they add $ 500 to it . That's what is says . Right ? Wrong ! That's what it says in the large print . But , there is something called the fine print . Why do banks hide the " terms and conditions in the fine print ? They know that a lot fewer people read the fine print . So , what are the terms and conditions for the free money ? Depends upon the bank . But , if you think that they are going to add the $ 500 , or whatever the ad said , to your account the day that you open it , it ain't gonna happen . There are usually numerous hoops that you need to jump through to get anything . You get a little piece of the windfall every time that you accomplish one of their terms . A common term is that if you have 3 , or some number , of direct deposits within X days you get a small piece of the advertised amount . If you don't , you get zilch . You also may have to maintain a certain minimum balance in the account for X days . If you drop below for 1 day , you get zilch . Oh , and in many cases , you must open an account online , not in person . Why , so they don't have to pay as many people to work in the branches . If you don't open online , you get zilch . Depending on the bank that you are dealing with , there could be many additional terms and conditions . Each time that you comply with one , you get a et a fraction of the promised total amount . How many people that open an account ever get the full amount in the large print ? We don't know . But it probably isn't many . FIRST SECURE COMMUNITY BANK OF JOLIET We're not just your bank , we're your neighbor ! Do you want to play games with a bank that wants to play games with you ? Most people don't . People want to do business , banking and otherwise , with people that they can trust and that will treat them right . That's what we do at First Secure Community Bank of Joliet . It's the only bank in the Joliet area that is majority owned by people that live in Joliet and is managed right here in Joliet . We're not just your bankers , we're your neighbors . Come see us . We're waiting for you . Joliet's Locally - Owned and Locally - Managed Billion Dollar Community Bank 2398 Essington Rd ( Corner of Essington and Caton Farm Rd ) ( 815 ) 230-8000 Visit 1stsecurebank.com MEMBER FDIC EQUAL HOISING LENDER Monster CD Rates 4.80 % 9 MONTH CD 4.60 13 MONTH CD $ 1000 minimum to open Limited Time Only . APY ** 2.23 % SAVINGS ACCOUNT RATE GUARANTEED NOT TO GO DOWN FOR ALL OF 2023 . $ 250 minimum . No maximum . * Annual Percentage Yield ( APY ) effective as of 1/11/23 . Minimum Balance to open is $ 250.00 . Fees may reduce earnings . Rate is guaranteed until 12/31/23 . After guaranteed date the rate will be a variable rate and is subject to change at any time and without notice . " Annual Percentage Yield ( APY ) effective as of 7717/23 . APY and terms are subject to change at any time and without notice . Minimum Balance to open and earn stated APY is $ 1,000 . Substantial penalty for early withdrawal . An early withdrawal penalty may reduce earnings . Maximum per household $ 100,000 . CDs will rollover at maturity to the then current rate , if not redeemed at maturity , as follows : the 13 month CD will rollover to a 12 month CD and the 9 month CD will roll over to a 6 month CD .